Small Actions, Big Clarity with Your Money

Start With Quick Wins

Make Spending Friction Visible

Shrink Decisions, Not Joy

Use Micro-Reviews to Stay on Track

Friday Five-Line Audit

Each Friday, write five short lines: biggest win, unexpected spend, one fix, one thanks to past-you, and next tiny action. This ritual takes three minutes and builds a narrative you can trust. Riley’s stress shrank after two weeks. Keep the notes in one place, scan monthly, and celebrate patterns of care taking shape through small, persistent attention.

Color-Coded Alerts

Set gentle notifications: green for savings landed, yellow for category thresholds, and amber for subscriptions renewing. The color cue turns data into emotion you can act on quickly. No panic, just guidance. Adjust thresholds seasonally, and mute alerts that create noise. Your goal is a calm cockpit for money decisions, not a chorus of alarms demanding urgency.

Build Tiny Protections

Mini-Emergency Cushion

Aim for a first milestone of one hundred to three hundred dollars, funded by round-ups and tiny transfers. This small cushion turns mishaps into inconveniences. When Leo’s tire blew, he paid calmly and avoided credit card spiral. Keep the money in a separate, nicknamed account for psychological distance. Replenish automatically after use to maintain steady protection without drama.

Bill Buffer

Create a one-paycheck buffer for essential bills by slowly pre-funding the account over several weeks. This timing cushion eliminates overdrafts caused by mismatched due dates. Ava shifted one bill by five days and gained breathing room. Set reminders to review dates quarterly, and ask providers about flexible schedules. Tiny calendar adjustments build a surprisingly sturdy foundation for calm operations.

Subscription Gatekeeper

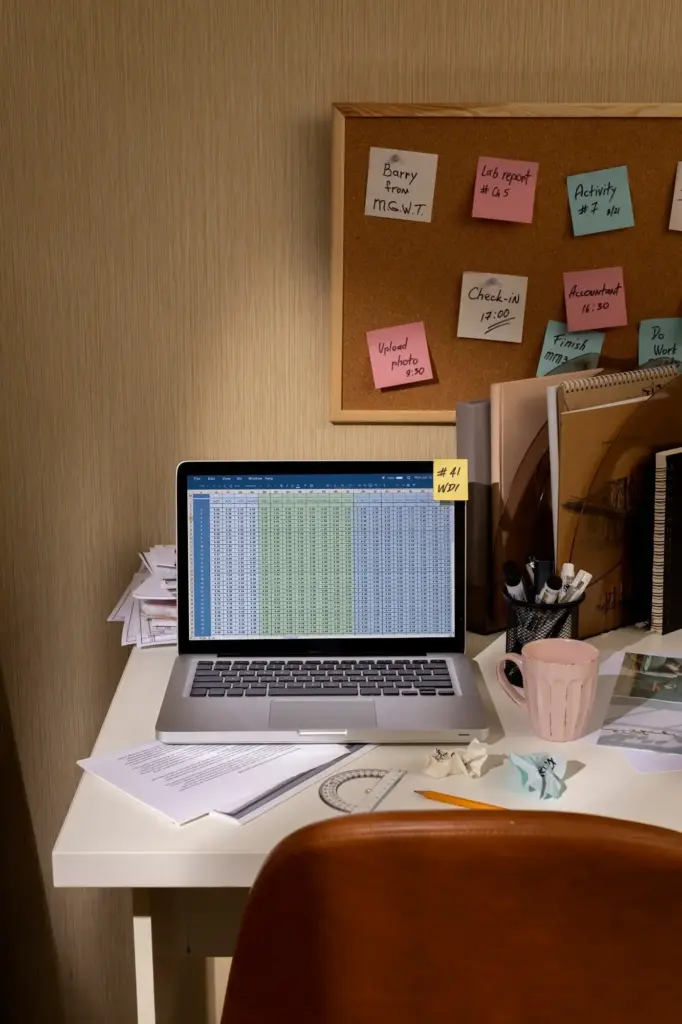

Route all subscriptions through one card or virtual card with a monthly review date. Before renewals, ask if the service still earns its keep. Marcus canceled three duplicates and redirected savings to travel. Keep a simple spreadsheet or note with start dates, costs, and purpose. Celebrate each cancellation by moving that amount to a named, energizing goal.

Turn Knowledge into Community Momentum

All Rights Reserved.